Precision in

Market Mechanics

Lock in Institutional Clarity. Real-time ATR feeding correct TRev settings—every single session. Eliminate retail noise.

Marathon Terminal

Real-time TRev settings, tick sizes, and session phase analysis. Built for Hyperliquid execution with institutional precision.

ATR-Based

Dynamic calculations using 14-period Average True Range

Session Aware

Adaptive thresholds for Asian, London, and New York sessions

Asset Optimized

Separate profiles for majors and volatile alts

Master the Physics of Price

We don't just teach setups. We teach you to read the raw data of the auction. From Gaussian distributions to granular crypto footprint rotations.

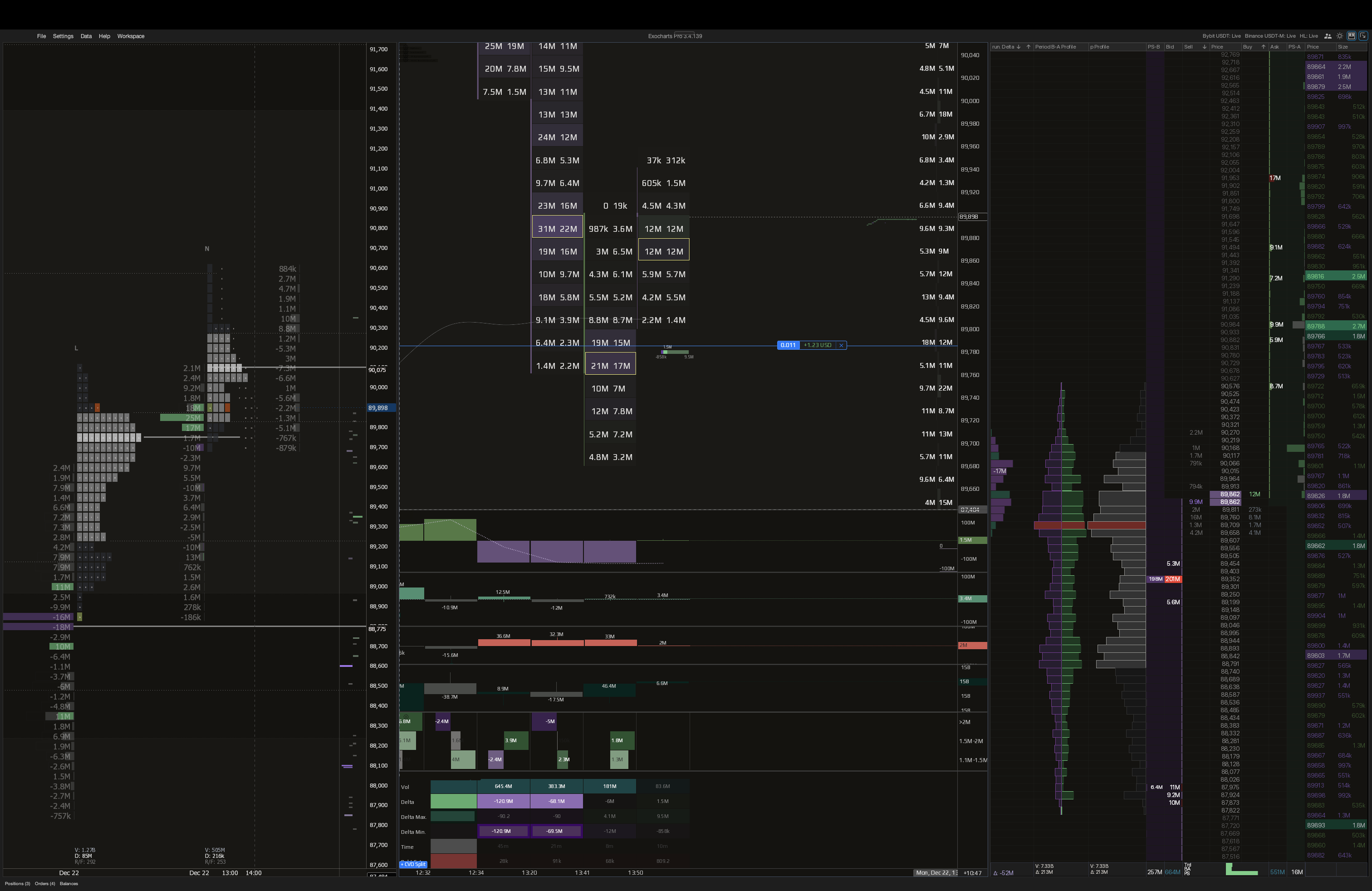

Auction Market Theory

Understanding Price vs Value via Net Longs/Shorts.

.png)

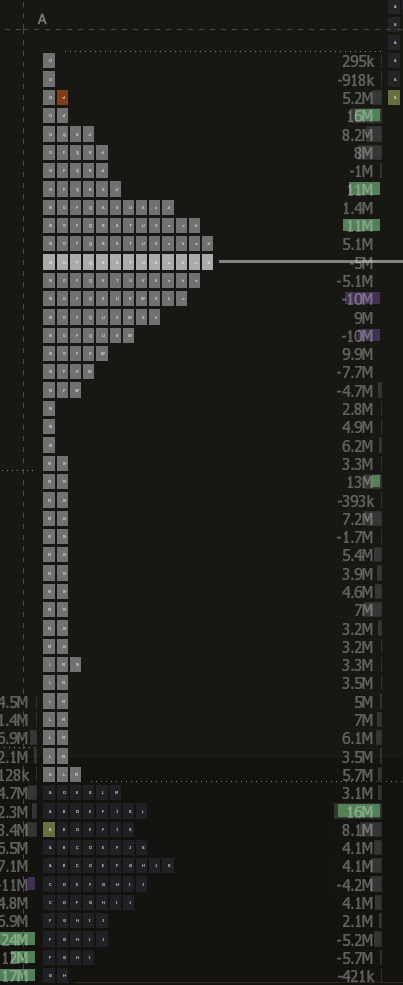

Structure & TPO

Decoding market context through Time-Price-Opportunity.

Orderflow & Footprints

X-Ray vision for Crypto. Spotting trapped traders & Delta.

Strategy Reference Map

Protocol plays derived from TPO profile structures and Order Flow triggers.

Basement Rebound

Micro Trigger

"Seller Absorption: Sellers hit bid, price holds. Tape flip."

Pinnacle Rebound

Micro Trigger

"Seller Trap: Aggressive selling absorbed + reclaim."

Gravity Fade

Micro Trigger

"Buyer Trap: Aggressive buying absorbed + reclaim."

Parabolic Trap

Micro Trigger

"Buyer Exhaustion: Buy clusters fail to lift price."

Equilibrium Breaker

Micro Trigger

"Initiative: Sustained Delta + OI expansion."

Reversal Ace

Micro Trigger

"Grand Slam: T-Size Absorp + Delta Stall + Tape/OI Flip."

Institutional Execution Protocol

Core Mandate: Real-time ATR feeding correct TRev settings. Lock in institutional clarity.

I. Macro & Composite Structure

The Battlefield

Composite Levels (CL)

- cPOC: High-probability magnet. Fade extremes back to cPOC. Do not initiate fresh directional trades here.

- cVAH / cVAL: Breakout implies macro imbalance. Rotation failure targets opposing side.

Reference Points

- nPOC: Untested POCs. Primary targets for liquidation cascades.

- Weak Refs: Double tops/bottoms. Targets to be repaired (swept).

II. DOM & Order Flow

The Trigger

Liquidity Shelves (The Wall)

High-density limit orders 5-10 ticks deep. Magnetizes price.

- Real: Orders remain. Trade toward it.

- Spoof: Vanish within spread. Ignore.

Absorption vs. Exhaustion

- Absorption (Defensive): High vol, price doesn't move. Iceberg refill. Reversal Signal.

- Exhaustion (Offensive): Vol dries up, Delta decreases. No participants. Reversal Signal.

III. Execution Logic: First vs Second Touch

First Touch (The Defence)

Price tests Macro/Composite level for first time. Liquidity is fresh.

Second Touch (The Breach)

Price returns. Wall is thinner. Liquidity depleted.

Desk Checklist (Pre-Entry)

Macro Context

Where are we relative to cVA and nPOCs?

DOM Check

Is there a liquidity shelf acting as magnet or wall?

Touch Count

First Touch (Limit) or Second Touch (Confirm)?

Profile Shape

Does TPO structure support trade (p vs b)?

TRev/ATR

Are settings calibrated to real-time volatility?

Invalidation

Hard stop defined.